What is a Balance Sheet?

A Balance Sheet, also known as a statement of financial position, is a financial

report that provides a snapshot of a company’s financial health at a specific

point in time.

It outlines what a business owns (assets), what it owes (liabilities), and the

owners’ stake (equity). Understanding this document is essential for evaluating

financial stability.

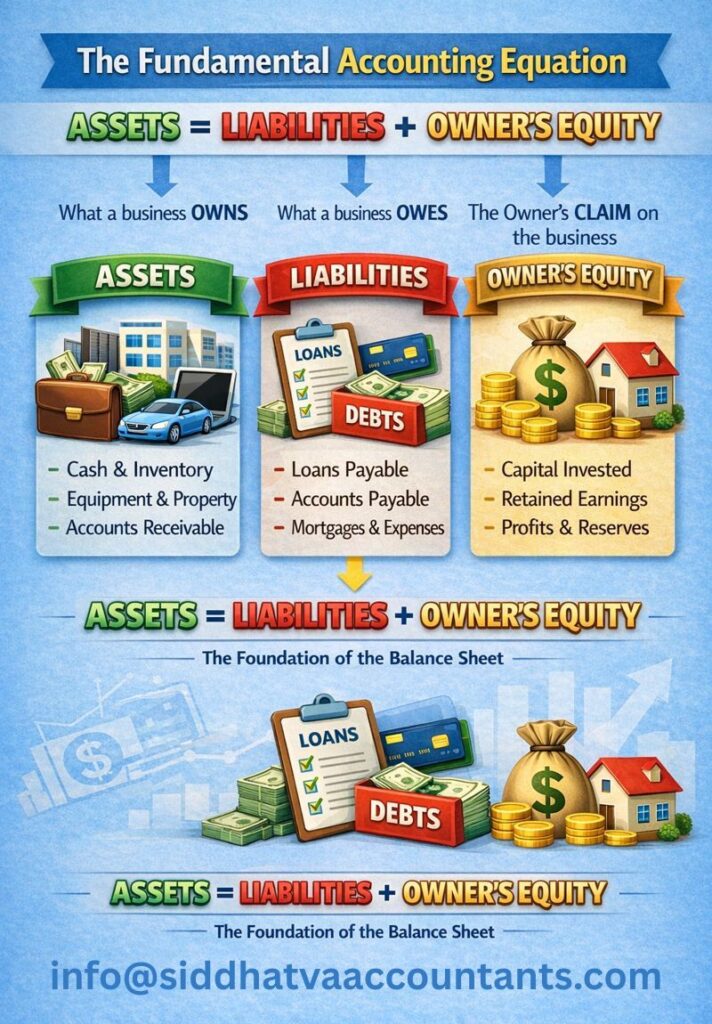

The Fundamental Accounting Equation

Assets (Resources owned by the business) = Liabilities (Obligations or debts owed to others) + Equity (The owners’ residual interest)

Balance sheets are typically prepared at the end of a reporting period, such as a month, quarter, or year.

Assets: What Your Business Owns

Current Assets

Expected to be converted to cash or used within one year

- Cash and cash equivalents

- Accounts receivable

- Inventory

Non-Current Assets

Long-term investments or assets used over multiple years

- Property, plant, and equipment (PPE)

- Intangible assets (patents, trademarks)

Liabilities: What Your Business Owes

Current Liabilities

Due within one year

- Accounts payable

- Short-term loans

- Accrued expenses

Non-Current Liabilities

Due after one year

- Long-term loans

- Bonds payable

- Deferred tax liabilities

Equity: The Owners’ Stake

Common Stock

Value of shares issued to shareholders.

Retained Earnings

Accumulated profits reinvested in the business.

Additional Paid-In Capital

Funds raised from issuing shares above par value.

Why is the Balance Sheet Important?

How to Read a Balance Sheet

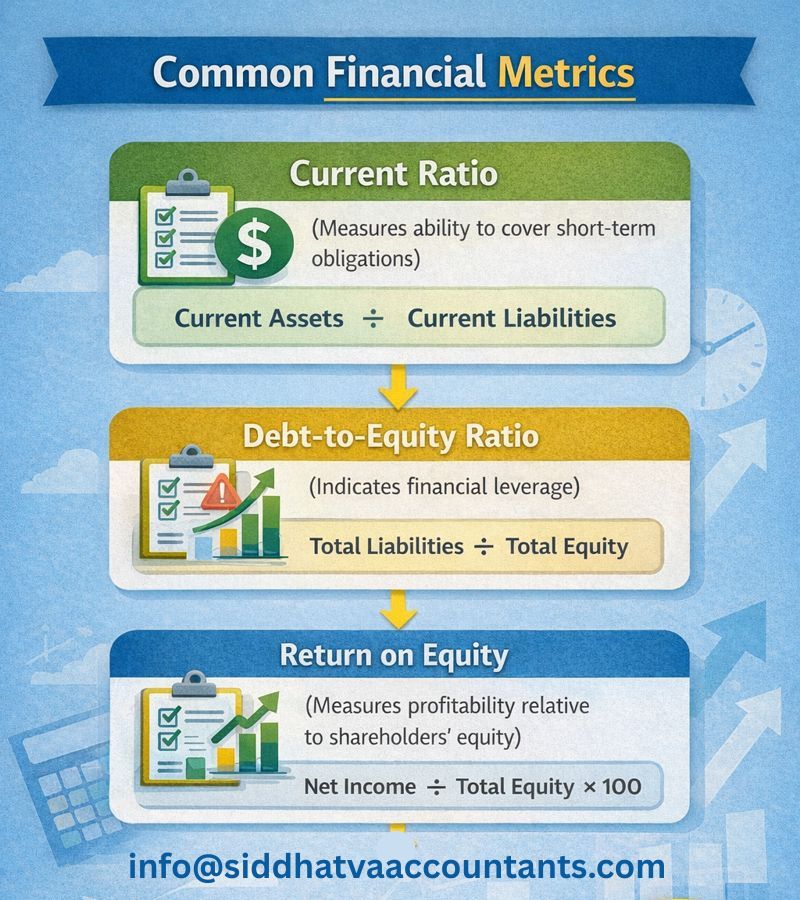

Common Financial Metrics

Working Capital: Fueling Operations

Working capital represents the liquidity available to a business for its daily operations. It’s the difference between a company’s current assets and current liabilities, indicating its short-term financial health and operational efficiency.

A positive working capital indicates a business has enough short-term assets to cover its short-term liabilities, suggesting good financial health. Conversely, negative working capital can signal potential liquidity challenges.

Operational Efficiency

Ensures smooth daily operations by covering immediate expenses like payroll and inventory.

Strategic Growth

Provides funds for expansion, new projects, and seizing market opportunities without external financing.

Financial Resilience

Acts as a buffer against unexpected downturns or seasonal fluctuations, maintaining stability.

Tips for Effective Balance Sheet Use

Regular Reviews

Update and analyze balance sheets periodically to monitor financial health

Compare with Industry Standards

Benchmark ratios like debt-to-equity against competitors

Combine with Other Statements

Use alongside the P&L statement and cash flow statement for a complete financial picture

Leverage Software

Tools like QuickBooks, Xero, or Excel can simplify balance sheet creation and analysis

The balance sheet is a vital tool for understanding your company’s financial position and making informed business decisions.