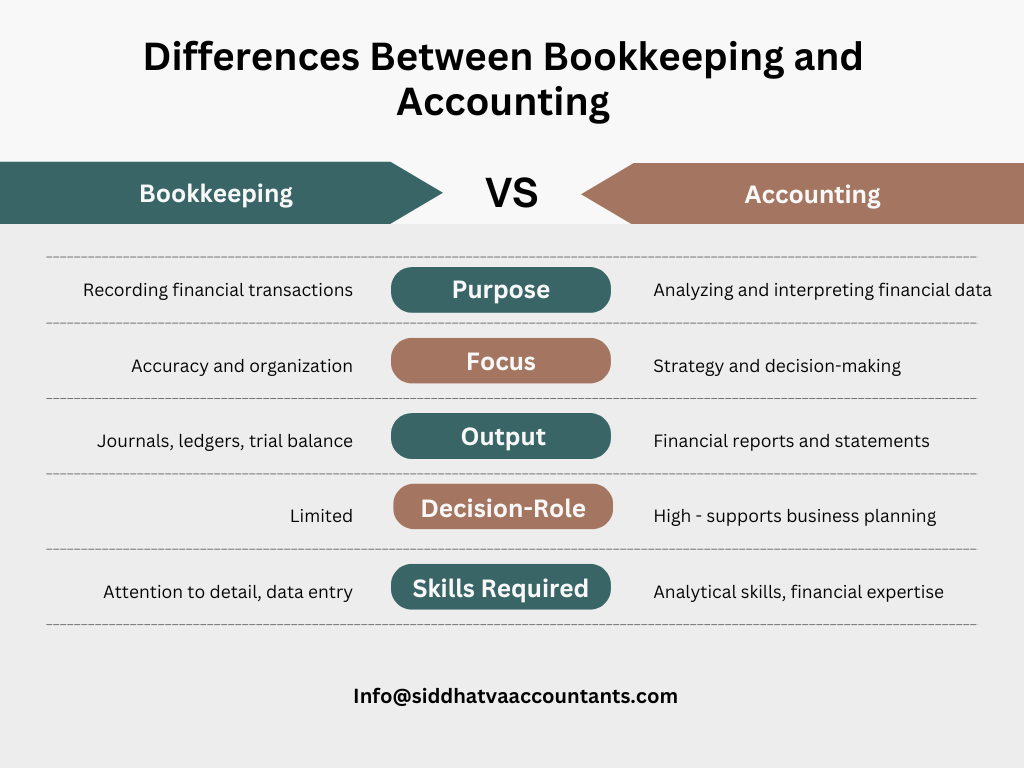

In the world of finance and business, the terms bookkeeping and accounting are often mentioned together, but they are not the same. Both play vital roles in maintaining a company’s financial records, yet each serves a distinct purpose. Understanding the difference between bookkeeping and accounting helps business owners manage finances more effectively and make informed decisions.

What is Bookkeeping?

Bookkeeping is the process of recording and organizing financial transactions on a daily basis. It ensures that every financial movement from sales and purchases to payments and receipts is properly documented.

Key functions of bookkeeping include:

- Recording daily transactions

- Managing invoices, receipts, and payments

- Reconciling bank statements

- Maintaining ledgers and journals

- Tracking cash flow and expenses

Example:

If your business makes a sale, the bookkeeper records the transaction in the company’s ledger and updates the financial records to ensure accuracy.

What is Accounting?

Accounting goes a step further by analyzing, summarizing, and interpreting the data that bookkeepers record. The goal of accounting is to understand a company’s financial performance and guide decision-making.

Core functions of accounting include:

- Preparing financial statements (Balance Sheet, Income Statement, Cash Flow Statement)

- Conducting financial analysis and audits

- Creating budgets and forecasts

- Managing tax filings and compliance

- Offering financial planning and advice

Example:

An accountant reviews bookkeeping records to prepare quarterly reports, evaluate profits, and suggest ways to reduce costs or increase revenue.

How They Work Together

Bookkeeping and accounting complement each other. Bookkeeping provides the foundation by ensuring all transactions are correctly recorded, while accounting builds upon this data to produce insights and reports. Without accurate bookkeeping, accounting cannot function effectively.

Which One Should You Choose?

Every business needs both.

- Startups and small businesses usually start with bookkeeping to keep track of daily finances.

- As the business grows, accounting becomes crucial for financial analysis, compliance, and strategic planning.

In short, bookkeeping keeps your records clean, and accounting helps you understand what those records mean.

Conclusion

Bookkeeping and accounting may appear similar, but their roles are distinct. Bookkeeping focuses on accurate data entry, while accounting turns that data into financial insights. Together, they form the backbone of every successful business’s financial management system.

Call to Action

Looking to organize your finances and make better business decisions? Start by ensuring your bookkeeping is accurate and your accounting is insightful.

Connect with us today to strengthen your financial foundation and take your business to the next level.