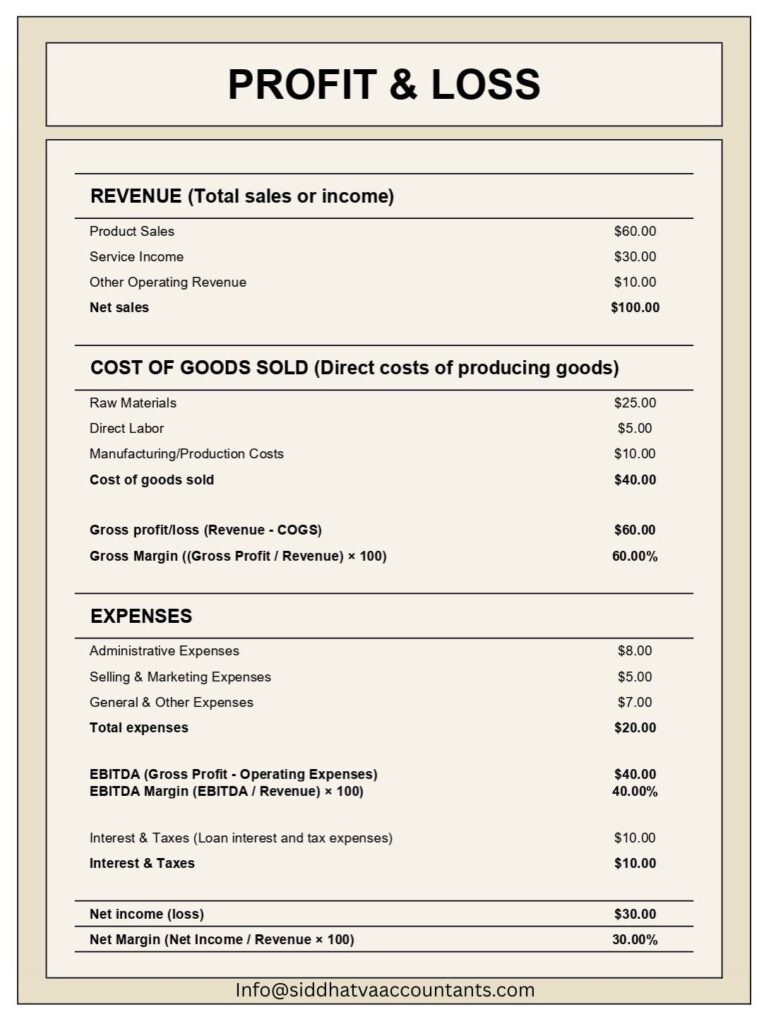

A Profit & Loss (P&L) Statement, also known as an income statement, is a financial report that summarizes a company’s revenues, expenses, and profits (or losses) over a specific period. It’s a critical tool for understanding a business’s financial performance and making informed decisions. Whether you’re a business owner, investor, or financial enthusiast, here are the key points you need to know about P&L statements. What is a P&L Statement? The P&L statement provides a snapshot of a company’s financial health by detailing:

- Revenues: Money earned from sales or services.

- Expenses: Costs incurred to generate revenue.

- Net Income: The profit (or loss) after subtracting expenses from revenues.

It’s typically prepared monthly, quarterly, or annually and is used by stakeholders to assess profitability, operational efficiency, and trends over time.

Key Components of a P&L Statement

Revenue

- Represents the total income from goods sold or services provided.

- May include categories like product sales, service income, or other operating revenue.

- Example: A retail store’s revenue includes sales from clothing and accessories.

Cost of Goods Sold (COGS)

- Direct costs associated with producing goods or services sold.

- Includes raw materials, labor, and manufacturing costs.

- Example: For a bakery, COGS includes flour, sugar, and wages for bakers.

Gross Profit

- Calculated as: Revenue – COGS.

- Indicates how efficiently a business produces goods or services.

- A higher gross profit margin suggests better cost management.

Operating Expenses

- Costs not directly tied to production, such as rent, utilities, marketing, and salaries for administrative staff.

- Often categorized as selling, general, and administrative expenses (SG&A).

- Example: Office rent and advertising costs.

Operating Income

- Calculated as: Gross Profit – Operating Expenses.

- Shows profitability from core business operations before interest and taxes.

Other Income and Expenses

- Includes non-operating items like interest income, interest expense, or gains/losses from asset sales.

- Example: Interest paid on a business loan or income from investments.

Net Income

- The final profit or loss after all expenses, taxes, and other income are accounted for.

- Calculated as: Operating Income + Other Income – Other Expenses – Taxes.

- A positive net income indicates profitability, while a negative value indicates a loss.

Why is the P&L Statement Important?

- Performance Evaluation: Helps assess whether a business is profitable and how effectively it manages costs.

- Decision-Making: Guides pricing strategies, cost-cutting measures, and investment decisions.

- Investor and Lender Insights: Investors and banks use P&L statements to evaluate financial health and creditworthiness.

- Trend Analysis: Comparing P&L statements over time reveals growth patterns or areas needing improvement.

How to Read a P&L Statement

- Start with Revenue: Look at the top line to understand the business’s income-generating ability.

- Check Gross Profit Margin: Divide gross profit by revenue to assess production efficiency.

- Analyze Operating Expenses: High expenses relative to revenue may indicate inefficiencies.

- Evaluate Net Income: A consistent positive net income signals a healthy business.

- Compare Over Time: Look at multiple periods to identify trends or seasonal patterns.

Common Metrics Derived from P&L Statements

- Gross Margin: (Gross Profit / Revenue) × 100

- Measures profitability after accounting for production costs.

- Operating Margin: (Operating Income / Revenue) × 100

- Shows efficiency of core operations.

- Net Profit Margin: (Net Income / Revenue) × 100

- Indicates overall profitability after all expenses.

Tips for Using a P&L Statement Effectively

- Regular Updates: Review P&L statements monthly or quarterly to stay on top of financial performance.

- Benchmarking: Compare your P&L metrics to industry standards to gauge competitiveness.

- Break Down Expenses: Identify areas to cut costs without compromising quality.

- Use Accounting Software: Tools like QuickBooks or Xero can automate P&L creation and analysis.

Conclusion

The P&L statement is a vital tool for understanding a business’s financial performance. By breaking down revenues, expenses, and profits, it provides actionable insights for stakeholders. Regularly analyzing your P&L statement can help you make informed decisions, optimize operations, and drive long-term success. Want to dive deeper into financial statements or need help analyzing your P&L? Let us know in the comments or explore our other financial guides!