Unlocking Financial Expertise

In the ever-evolving landscape of business, financial acumen is more critical than ever. Small and mid-sized businesses often find themselves facing complex financial challenges that demand specialized expertise. Enter the Fractional Chief Financial Officer (CFO), a strategic solution that provides access to seasoned financial professionals without the commitment of a full-time hire. But what exactly are Fractional CFO services, and how can they benefit your business? Let’s explore.

Demystifying Fractional CFO Services

Fractional CFO services are a flexible and cost-effective alternative to hiring a full-time Chief Financial Officer. This model allows businesses to tap into the experience and expertise of a highly skilled CFO on an as-needed basis. These services can cover a wide range of financial functions, all tailored to your specific requirements.

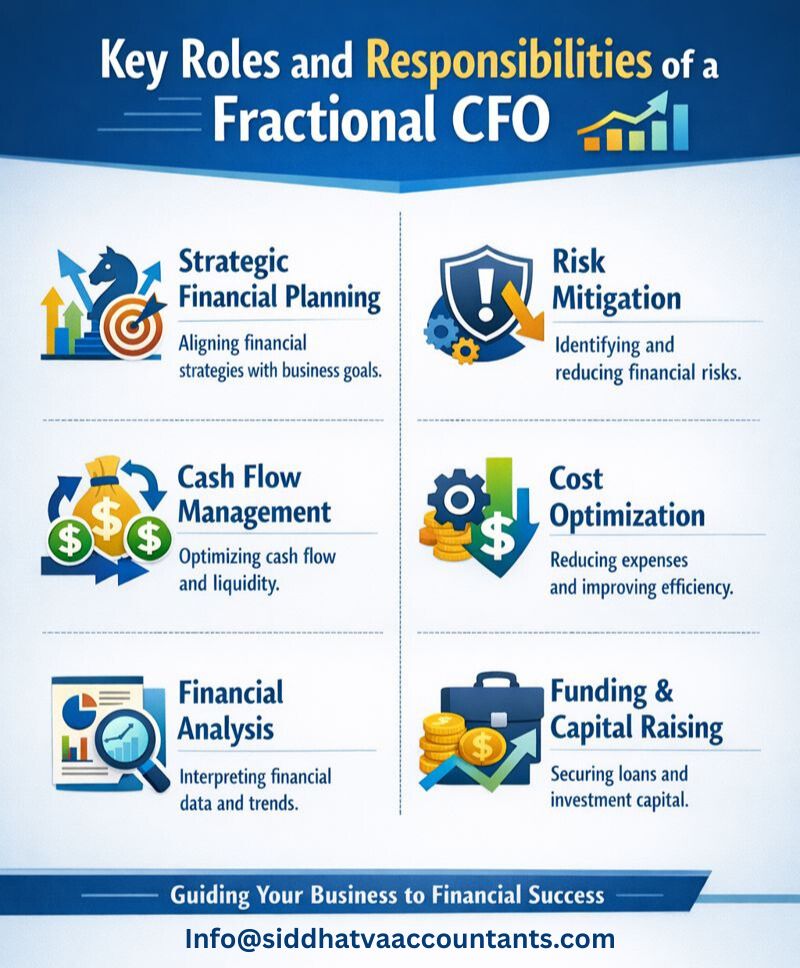

Key Roles and Responsibilities of a Fractional CFO

Strategic Financial Planning

A fractional CFO collaborates with your leadership team to align financial strategies with your business goals. They develop financial plans that support your company’s growth and long-term success.

Cash Flow Management

Ensuring your company’s financial health is maintained by optimizing cash flow. A fractional CFO monitors and manages your cash flows, preventing financial crunches and identifying opportunities for investment.

Financial Analysis

Your fractional CFO provides insights by interpreting financial data and reports. They pinpoint financial trends, assess risks, and offer recommendations for improvement.

Risk Mitigation

Fractional CFOs are experts in identifying and mitigating financial risks, helping you navigate volatile markets and external economic challenges.

Cost Optimization

These professionals identify areas where costs can be reduced, enabling you to maximize profitability and allocate resources more efficiently.

Funding and Capital Raising

If your business requires funding for expansion, a fractional CFO can help secure the necessary capital through loans, investments, or other financial instruments.

The Benefits of Fractional CFO Services

Expertise on Demand

You gain access to a seasoned financial professional with years of experience, without the commitment of a full-time hire.

Cost-Efficiency

Fractional CFO services can be more cost-effective than maintaining a full-time CFO, as you only pay for the services you need.

Flexibility

You can scale up or down based on your business needs, adjusting the level of CFO services as your company evolves.

Objective Perspective

An external fractional CFO can provide an unbiased and objective view of your financial situation, identifying issues and opportunities that might be overlooked by an internal team.

Focus on Core Competencies

With financial management in capable hands, you and your team can concentrate on your core business operations and growth strategies.

Conclusion,

Fractional CFO services are a powerful resource for businesses seeking financial expertise without the commitment of a full-time hire. They offer tailored financial solutions that drive growth, financial stability, and informed decision-making. If you’re looking to optimize your financial management and ensure a prosperous financial future for your business, exploring fractional CFO services could be the key to your success.